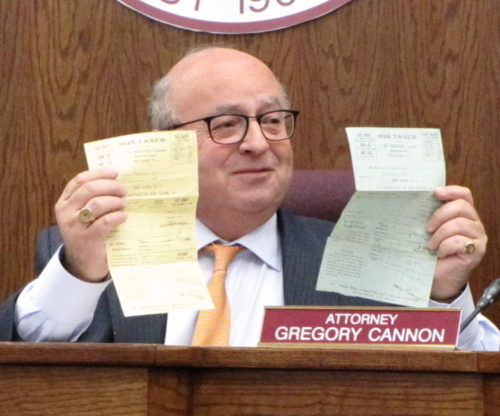

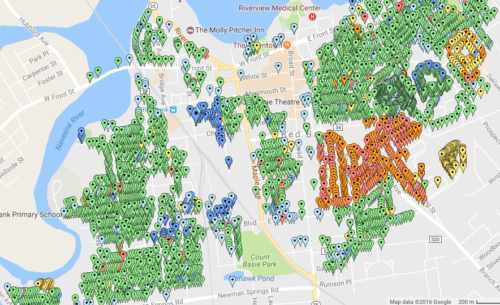

RED BANK: Average home tax bill nudges past $10k as budget keeps pace with inflation and town eyes big capital projects.

Tag Archives: assessment

Remember: Nothing makes a Red Bank friend happier than to hear "I saw you on Red Bank Green!"

Partyline